HAWAII CENTRAL FEDERAL CREDIT UNION PRESENTS $5,000 CHECK TO CHAMINADE WOMEN’S SOFTBALL TEAM

HAWAII CENTRAL FEDERAL CREDIT UNION PRESENTS $5,000 CHECK TO CHAMINADE WOMEN’S SOFTBALL TEAM

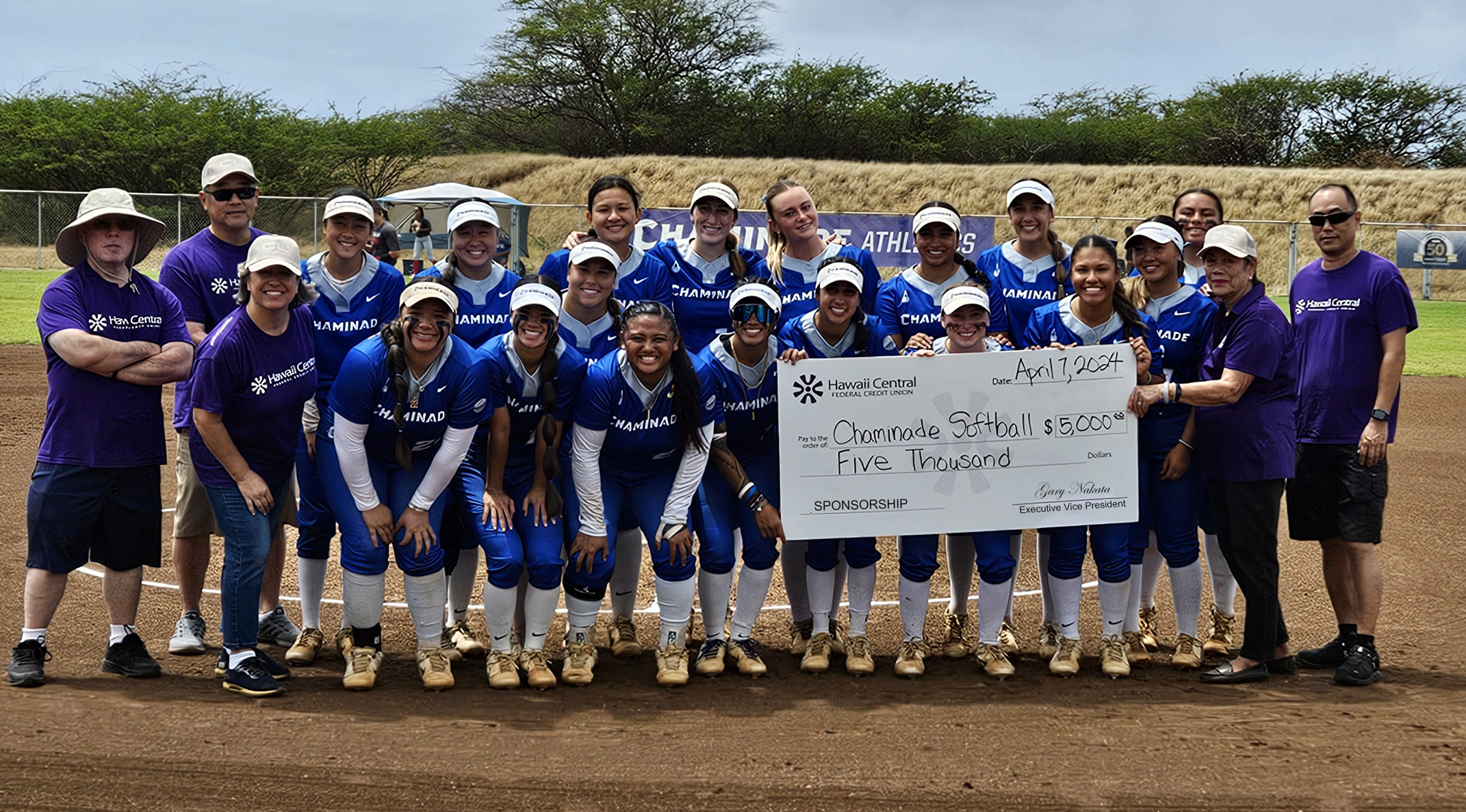

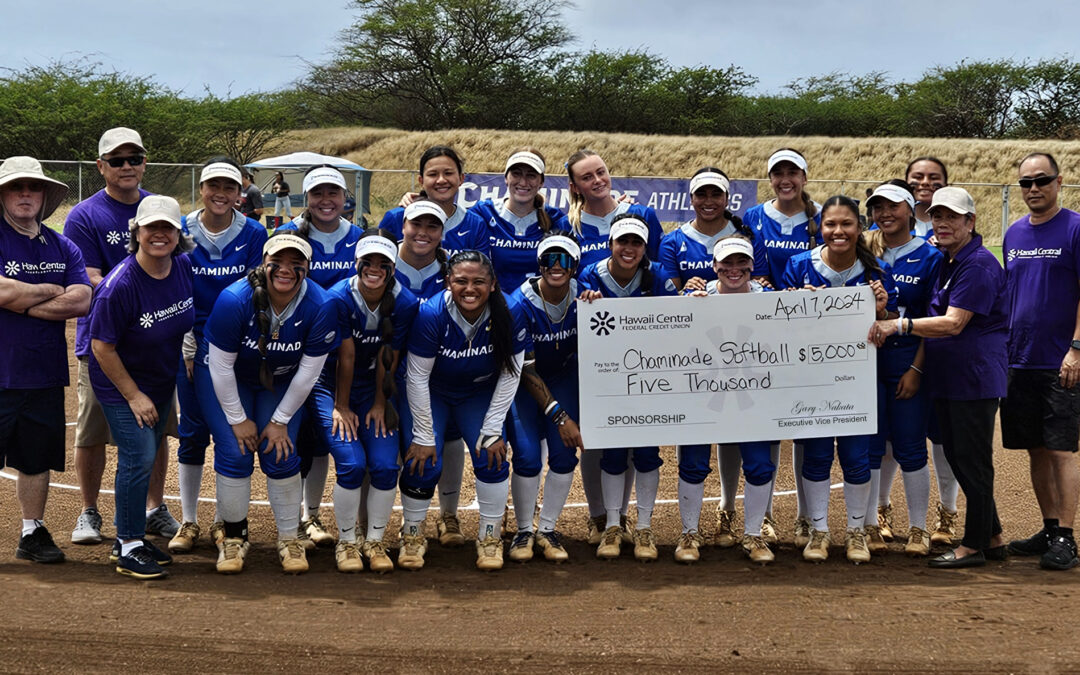

HONOLULU, HI—Hawaii Central Federal Credit Union (FCU) presented the Chaminade Women’s Softball Team with a check for $5,000.00 before their game against Academy of Art on April 7, 2024.

“Studies have shown the positive impact sports have on the lives of students, both on their grades and their self-esteem,” said Hawaii Central FCU President Drake Tanabe who knows the difficulties of being a student athlete. “The ladies work so hard. Many participate in the program for little more than the love of the game, an example set by Coach Kent [Yamaguchi].”

“I’m proud of the team both on and off the field,” said Coach Kent who commented that the ladies understand academics are as important as the game and participate in community events whenever chances arise.

Coach Kent has volunteered his time coaching Chaminade Women’s Softball for nearly 20 years and his dedication shines through with his winning track record, unmatched at the school. In 2023, the team led the Pacific West Conference, set a school record with 24 triples, and ranked fifth in NCAA Division II with a 0.52 per game average. With 22-24 record and 14-17 conference win totals, the most since 2013, the team had a successful season that culminated in a record—six All-PacWest selections.

Caption: Hawaii Central Federal Credit Union Presents Chaminade Women’s Softball Team with a $5,000 Check. Executive Vice President Gary Nakata, President Drake Tanabe, and Community Relations Officer Amber Milsap are pictured here to the left of the Team and Board Director Ariel Chun and Marketing Manager Travis Uchino on the right.

About Hawaii Central Federal Credit Union

Hawaii Central Federal Credit Union is currently recognized by FORBES as one of the top three Credit Unions in the State of Hawaii. Founded in 1937, Hawaii Central Federal Credit Union is a member-owned, not-for-profit financial institution serving over 17,000 members and has over $300 million in assets. Membership is open to all individuals who live, work, worship or attend school on Oahu. Businesses and other legal entities on the island are also eligible for membership.